Crypto Mining

Genesis Mining: Best Bitcoin Cloud Mining Pool to Earn Crypto Profits?

About Genesis Mining

A hashpower rental agent, Genesis Mining has joined the portals enabling users to mine cryptocurrencies without incurring the substantial expense of establishing a mining rig.

A smart platform that makes it simple for a user to log in and buy power, the company pitches its offer at the majority of cryptocurrency enthusiasts who won’t likely set up an extensive home-based mining outfit. That said, larger mining houses also avail themselves of the Genesis Mining offer.

Focused on optimized mining since 2014, the platform mines what it considers the most popular cryptocurrencies. Rather than mine “an overcrowded market,” the company steered mining into alternatives to bitcoin which can later be traded for BTC.

This approach allows users to skirt the issues facing many, especially individual miners at present – the failing profitability of bitcoin mining. With the balance of power and profitability experiencing a teeter-totter existence, mining on the Genesis Mining platform avoids those difficulties altogether. As a result, many users are not mining bitcoin, but rather following other crypto mining protocols that ultimately pay dividends in BTC.

Bitcoin mining remaining popular nonetheless, the platform’s two million users retain the ability to mine the flagship coin directly through the platform.

Each user has faced the choice between buying into cryptocurrencies and setting up mining as an individual, or buying hashpower from a company like Genesis. While all bitcoin enthusiasts accept mining as a component of the blockchain construct, many more actively mine the coin. The question remains as to whether one should mine as an individual or make use of computing power available from brokers like Genesis Mining.

Many considerations prevail when a user considers mining, not least of which is the cost of the equipment needed. Electricity costs feature as a prominent consideration, as mining is power-intensive. Added to this comes bitcoin’s volatility, meaning a day’s mining can seem profitable at the outset, but ultimately return a loss at times.

Currently one of the largest players in the crypto mining scene, the company is the product of one miner’s experience of freeing up the wealth of altcoins. Started by Marco Streng in 2013, this Munich-based platform allows anyone to register and begin mining within minutes.

As the cloud-mining option gains in popularity, various platform offers diversify. As an example, Genesis Mining allows users to switch their mining power in order to target any altcoin listed on the exchange.

Why Choose To Mine With Genesis Mining?

Gentle to newcomers and smart for experienced users, Genesis Mining does have better accommodation for both individual as well as bigger demands. While most hashpower brokers have a decided lean towards either smaller bread-and-butter users or alternatively giant block sales to large mining concerns, Genesis won’t delay either party in getting up and mining in as short a time as possible.

Credit card payments are accepted by the company, allowing for a user-friendly interface where cryptocurrencies and fiat currencies can be used as payment. The company’s bitcoin mining algorithms are geared for the most profitable mining rentals. The hardware at play is state of the art and technology is all optimized to ensure miners are digging with the latest technology.

Because the company literally traveled the world to establish electricity charges in various countries, Genesis’ setup is thus optimized on two fronts: the latest hardware makes quick sense of mining activity, and the location of servers carries cost savings for users.

Streng has drawn on his own initial experiences of mining to build a UI that sees zero downtime and an overall “pleasant” experience. The company also makes much of being a “real company with real people working for it,” and Streng has built a user-friendly dashboard that sees many opt for the convenience and relative quiet of online mining.

Clearly a product of millennial concerns, Streng states onsite that the people involved are “traceable and transparent,” and goes on to add that he hopes people will notice the company’s pro-activity on forums and at conferences. Genesis deserves kudos for making transparency and visible fallibility a user-facing focus. Happy to journey openly with users and address issues as they arise, Genesis has far greater integrity than many other hashpower brokers out there.

In a bid to establish itself as a legitimate bricks and mortar offer, Streng has previously released photos on various platforms depicting the company hash farm in Iceland, amongst other infrastructure. The company is also planning a facility where users can actually watch live streaming of the mining rigs at work on their contract.

Streng went on record to say that he believes the trust factor is critical to the future success of the cryptosphere. Opining that another Mt Gox would not be good for the scene, Streng has worked hard to build a platform without hidden surprises. As to exactly how much hashpower Genesis mining can dispense, it appears that it operates in the range of several GH/s in the Scrypt mining arena, making it one of if not the largest supplier in this space.

Apart from a user-friendly build and a formulated approach to locales, based on previous, extensive homework, the company has also been aware of local regulations when establishing its hash farms in various countries.

The platform’s build has been logical, sometimes fortuitous (as in the case of their Chinese connection whom Streng met at a Berlin conference) and always user-focused. With an abundance of crypto fintech companies presenting a thinly-veiled offer that barely conceals their greed and paper-thin value, Genesis Mining has an open credibility few share.

Genesis Facts, Figures and Folklore

The company has spilled green thinking all along its route to establishment, and now heats a Bosnian school with the exhausted air generated by that mining rig station. When the company released its “lifetime contracts” offer, their servers went down under the heavy user demand, such was the uptake.

Looking at the current realities, users spending around $18 can expect to earn just $0.38/day, based on MH/s profitability. This means that it will take around two to three months to reach break-even. That said, the calculations reveal that Genesis is selling some pretty cheap hashpower. Looking at both base and input costs of establishing one’s own mining rig or buying hashpower from other similar brokers, some observers wonder how it’s possible that the company can offer such good prices to users.

Firstly, Streng set about minimizing unavoidable costs by targeting countries where electricity is cheap for mining purposes. Secondly, he negotiated great deals from suppliers in order to keep hardware costs down on mining rigs. Thousands of ASIC cards and accompanying rigs were purchased by Genesis to establish their offer, with a diversified bouquet also looming.

In addition, the company’s “Project X” allows miners to mine x11 and x13 algorithms. Dutifully aware of user temperament, Genesis is also responsive to user sentiments with Dogecoin and others to be added to the portfolio available to miners.

User forums show that there have been moans about the company, although these tend to concern the viability of mining, not lost funds or other negative experiences. It remains impossible to peg a uniform experience for users across the globe, but some calculations in chat rooms point to elusive ROI.

Most critique of the platform stems from calculations that extrapolate over a year or two, pointing to an ever-elusive return for the costs of mining. This seems to be more a reflection of coming down to the coalface of crypto, rather than a peculiarly greedy slant on the part of Genesis Mining, however. The company remains at pains to address user issues and – in comparison with its peers – seems at the forefront of maintaining genuine care and transparency.

Genesis Mining Conclusion

With regular promotions awarding miners vouchers for additional free hashpower and even upgrades, the site is popular for good reason. Although the company also entices members to enlist their friends and associates through an “affiliate” structure, this is nowadays less cheesy than it used to be, and something of a basic expectation from startups.

Without downtime due to crashes, and no pool fees (no pay-and-wait-a-moment as with other outfits of this nature) Genesis Mining is hitting a sweet spot for many with their costs and associated services. Loyal users swear by the speed and transparency of the rental concern, and it is demonstrable in the technical build that the development team have tried to optimize UX rather than any in-house benefits.

The company occasionally adds altcoins to its offering, polling users via Facebook to determine new additions of benefit to all. The company presents a diversified mining offer to users, who can mine cryptocurrencies that are scrypt algorithm-based coins and also those running on a proof of work (PoW) algorithm, too. ASIC and GPU mining is no sweat with Genesis either, and combined with speed and simple transparencies that populate the platform build, make it the default hashpower supplier for many.

You can learn more by visiting their official website: Genesis-Mining.com

Crypto Mining

Most Fascinating Cryptocurrency Mining Facts in 2018 to Know About

Interesting Cryptocurrency Mining Facts

With the rising popularity of cryptocurrencies a, it has become very important to separate facts from fiction. This is particularly important when it comes to cryptocurrency mining.

As more people try to get into cryptocurrency mining, many are finding out that it’s not quite what they envisaged. This is why we have written this facts based article to give intending investors a more realistic and objective overview of the crypto mining space. That said, let’s jump right in.

Cryptocurrency Mining is Rife in China

It is estimated that nearly 75 percent of the bitcoin mining pool is located in China. This is ironic in the sense that China itself has banned bitcoins as a cryptocurrency and all associated activities.

As a result, Chinese law enforcement agencies are actively cracking down on bitcoin mining pools located in the country. A recent incident involved the seizing of 600 bitcoin mining hardware in Tianjin from bitcoin miners who were using them.

Bitcoin Mining is Less Profitable and More Expensive

Before 2016, the reward for mining a bitcoin block was 25 BTC. Now, it’s been halved to 12.5 BTC per block mined. This will continue for another 210,000 blocks mined, and then halved again and so on.

This means that bitcoin mining isn’t as financially rewarding as it was a few years ago. Worse still, it has become increasingly more difficult to mine. This is because of the increased complexity of calculations miners need to solve before they can mine a block.

In a bid to increase profitability in the face of soaring equipment and energy costs, many miners have moved to localities with cheap energy costs.

Many are beginning to contemplate Scandinavian counties like Norway and Sweden, while others are looking to relocate to Venezuela where thee electricity cost required to mine 1 BTC is less than $600.

For those who can’t move, they are choosing to rent miners from mining pools and hoping to get paid for those miners. This is known as cloud mining.

Many are quickly jettisoning solo mining and joining mining pools in the hopes of profit maximization. If you’ll be joining the bitcoin mining trend, we do recommend pool mining as against doing it all alone.

Proof of Stake and Proof of Work Drive Bitcoin Mining

You would have heard of these two terms if you’ve been around. More popularly known as PoS and PoW respectively, these are the major mechanisms that drive the cryptocurrency industry.

PoW is the most popular with a 30 percent share, while PoS only boasts of 18 percent. There are also cryptocurrencies that combine both mechanisms. These are called hybrids and account for 8 percent, while a small 4 percent represent Proof of Importance (PoI) and Proof of Capacity (PoC).

If you want to mine cryptocurrencies, it would be safer to mine those using PoS or PoW mechanisms as they are popular and in demand. In case you were wondering, Bitcoin uses PoW.

Bitcoin Mining Chips Have Evolved

Bitcoin mining has come a long way from the early days when they could be mined on computers. Those days, you only needed a laptop or desktop to do the job. As it increased in value and demand, it needed more powerful processing units.

This birthed the need for graphics processing units (GPU) which were capable of producing more output faster. They were followed by FPGAs and now the more efficient and effective Application Specific Integrated Circuits (ASIC) miners.

Although these miners are often expensive to buy –usually costs between $1,000 and $3,000- they are currently the best hardware miners for bitcoins and other cryptocurrencies as they have high hash rates.

Crypto Mining

NiceHash: Bitcoin & Cryptocurrency Mining Hash Power Marketplace

About Nicehash

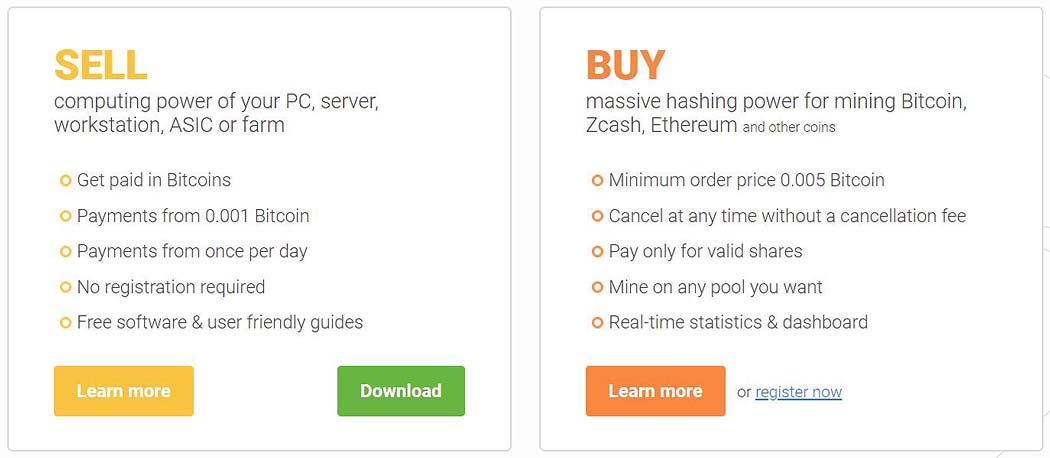

With the last few years’ arrival of computing power marketplaces, NiceHash [NiceHash.com] is emerging as one of the largest and most successful.

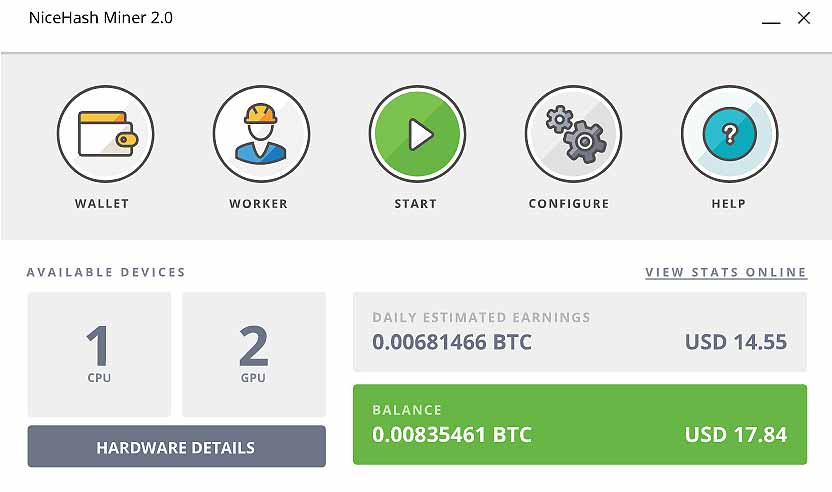

Based on a model of a mutual economy, buyers and sellers of computing power contribute to the platform from all over the globe. The computing power traded on the platform is tailored to apply to altcoin mining. Having emerged as a logical upshot of mining protocols generating profits in a new asset class, the company provides power sellers with an easy way of earning money via NiceHash Miner.

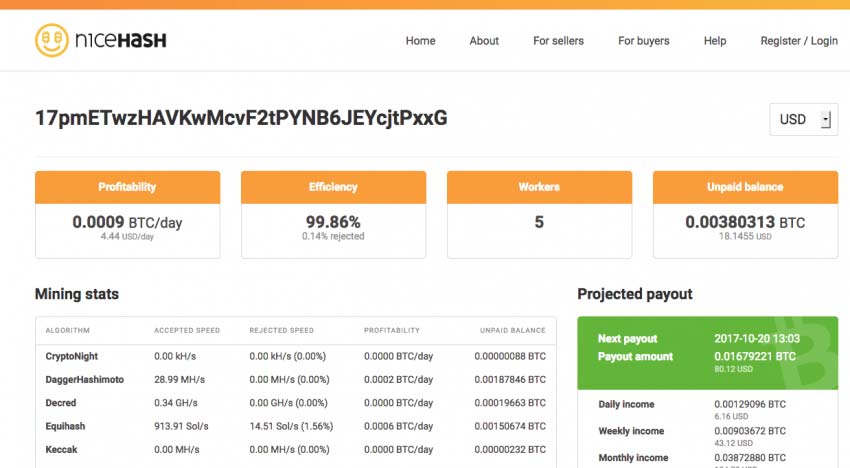

As a seller on the site, the GUI software auto-sells available computing power to competing buyers for the highest price. As the computing power is remotely employed, the site’s dashboard gives sellers pertinent data and intel to optimize regular mining.

With the NiceHash marketplace, buyers can shop for any amount of hashing power on any major hashing algorithm, and can mine new and established altcoins on a pay-as-you-go structure. Moreover, on the platform, buyers are free to make immediate bids on available power without having to be tied into any longer-term arrangement once their needs have been met.

Indeed, the company does not force an onerous registration process to endure before trading on NiceHash. Although the company suffered a loss of around $63 million to a hack – an incident that cost the CEO his job – it seems a successful patch has been applied to that possibility in future. The company has since been at pains to highlight their successful addressing of such potential going forward.

NiceHash Services Immediate Hashing Needs

Although Cloud Mining has attracted loads of negative press, with frequent scams and hidden costs abounding, NiceHash has avoided both greed and bad publicity. Often billed as a “multi-mining pool” that allows miners to employ any hashing algorithm, the power exchange has a large user base of some quarter of a million daily users.

Ranked as a serious cloud miner, the company opened for business in 2014. Since then, miners seeking additional power can employ the platform to enjoy a quick and wholly automated process that gets them the computing power they need. All payment protocols are crypto-centric and the developers have streamlined all processes to enable a fast, easy transaction at every turn.

Some of the site’s benefits include the fact that the AI at play will switch between cryptocurrencies, based on prevailing market prices. In other words, the profits from mining a certain coin on a certain algorithm may be surpassed by another altcoin while mining is underway.

In this case, the software will switch to mining the highest profit in real time and mine the other higher-value coin. For a myriad of reasons, sellers find that they have computing power to spare and a wide variety of algorithms to pursue. This has enabled a vibrant marketplace. So vibrant, in fact, that NiceHash offers tailored consumption solutions to large mining houses, and not just individual users.

With such an automated solution, many users enjoy concentrating on the basic figures to determine profitability, mining in an almost guaranteed way each day. The site’s software is geared, very much the intelligence at play in forex apps, to always maintain and maximize a miner’s profitability.

Sellers sell their availability on the hashpower exchange to miners looking for a profitable mining contract. The fees charged by Nicehash sit at three percent. All parties are paid only in Bitcoin. While the profitability of Bitcoin mining has been a hot topic within the cryptosphere recently, it seems that in spite of the fees levied by NiceHash, sellers are making acceptable money by selling their computing power. Indeed, it appears that for many, selling available power is more profitable than mining the currency themselves.

NiceHash Pools

Onsite, NiceHash displays guidelines and other intel for third-party pool operators and also pool users, and pools of users benefit from NiceHash through the massive hashing power accessible on the platform. Optimizing initial setup, a pool can also run through a trial phase simply buying hashing power to confirm that an overall mining rig is performing as expected.

The “renting” of the hashing input often enables a far more cost-effective arrangement, particularly for mining startups. Indeed, for some buying computing power, a marketplace like NiceHash is an essential leg-up, without which barriers to entry will remain. Spared the capex requirement to purchase hardware, many mining outfits could turn a profit no other way.

NiceHash pays 5 percent of an order’s value to participating pool users who secure additional clients. Through a loyalty protocol, users can earn commission fees by actively engaging others and getting them to employ the site’s services. For many involved with buying daily mining power via the site, especially on a large scale, NiceHash is an essential backup facility for when they have unavoidable downtown.

The company kicks into two imperatives – prevent wasted idle downtime for sellers and preventing those same contract miners from migrating to healthier pools, costing the buyer once they are back online. Particularly during longer downtimes, NiceHash attempts to mitigate losses and dispense power as equitably as possible to enable minimal losses all round.

Not only a massive amount of hashing power, but also tight security, a sleek experience and regular payouts await users. Support is adequate and responsive, and the platform is now entrenched as a go-to option for miners. The percentage of coin creation in the altcoin universe as a whole that NiceHash can lay claim to is unknown, but they are playing an important role in the crypto ecosystem.

Enabling transaction confirmation on several decentralized ledgers by indirectly providing new coin creation and transaction validation on several different blockchains. Here are some interesting facts in numbers:

NiceHash Exchange Conclusion

Listing “585,000+ daily active workers” and 166,000+ orders served and settled, NiceHash is growing and finding itself a persistently valuable service to users. Based in Slovenia, the company has banks of servers positioned across the globe. Payments happen from a frequency of daily and start at 0.001 BTC.

Offering an alternative to giant mining houses, or rather, their initial setup, anyone with enough available BTC can buy whatever volume of mining power they desire. For the ambitious, the platform ends up being very much a matter of needing money to make money from mining where the Bitcoin mining profitability threshold generally oscillates remains a volatile input.

With Bitcoin mining becoming dominated by powerful investors who run dozens upon dozens of mining rigs, typically Bitmain Antminer machines, many enthusiasts see the flexibility and potential power of NiceHash as a positive countermeasure.

Crypto Mining

Best Bitcoin Mining Software, Hardware & Cloud Mining Tips [GUIDE]

Bitcoin is the most popular cryptocurrency on the market, with many people often confusing it with the entire crypto market.

There are various ways to make money from bitcoins. One of these is bitcoin mining. In this guide, we’ll be providing you with all the information you need to decide if you want to start mining bitcoin, as well as how to go about it.

During the early days, you could mine bitcoin with your computers, CPUs and GPUs. That was all you needed at the time. But now, things have changed.

You need bitcoin mining hardware known as ASIC (Application Specific Integrated Circuit). ASIC miners are hardware devices that are solely designed to do just one thing –in this case, mine bitcoins. We’ll be looking at those later on.

While you can actually buy these and try to mine all by yourself, the profit margins have drastically dropped in the last few years. So, when it comes to mining, you can either solo mine or pool/cloud mine.

Solo mining will essentially result in lower returns. The smart way to make money from bitcoin mining is to jettison solo mining and go for cloud or pool mining. Cloud or pool mining typically produces better returns than solo mining, even if they attract some extra fees. Understanding how these work plays a key role in your eventual profits.

When bitcoin was created, miners were paid 25 BTC to mine just one block. Starting in 2016, that reward value dropped by half to 12.5 BTC per block.

This will further drop by half once another 210,000 blocks –usually within 4 years- are mined, and so on until the max available number of bitcoin in circulation is attained –the max number of bitcoins that can ever exist is 21,000,000.

So, come 2020, chances are that every block of bitcoin mined will only attract a 6.25 BTC payment. As you can see, doing this yourself doesn’t make any financial sense.

While you can try to mine it all by yourself, it’s simply easier and more financially rewarding to join a bitcoin mining pool. This way, you can split the proceeds between all members of the mining pool, based on their number of “nodes”.

And if you want to join a bitcoin mining pool, you will need ASIC bitcoin miners. Let’s examine some of the best bitcoin mining hardware in the market.

Top Bitcoin Mining Hardware for 2018 And Beyond

The hardware you use for mining bitcoins plays a significant role in determining your profits. For this, you’ll need energy efficient, high output ASIC bitcoin miners to help you get the results you want.

This is even more important in the face of rising competition and lower rewards per bitcoin block. As earlier stated, your best bet would be to join mining pools and split the profits with them as against going solo.

No matter how great your bitcoin miner is right now, it will most likely be overtaken by faster, more efficient, relatively lower energy consuming units in a few months. That said, here are the best bitcoin mining hardware for 2018:

Antminer S9

Manufactured by Bitmain, Antminer S9 is a more energy efficient unit with a competitive hash rate of 14 TH/s. it is a superb bitcoin miner and will probably be for a while.

Its current power usage is 1375 watts, which makes its energy savings twice as efficient as its predecessor the Antminer S7. Of course, it is somewhat pricey as it costs a minimum of $1,500 to purchase.

Please note that this price is subject to the state of the device (new, used or old) and where it’s purchased (price varies by vendors).

DragonMint 16T

Manufactured and sold by Halong Mining, the DragonMint 16T is another very impressive ASIC bitcoin mining hardware. In fact, it is currently described in the BTC mining community as the world’s most advanced bitcoin mining hardware.

This is because of its 16TH/s hash rate –something that’s never been achieved in the industry- and its remarkable power efficiency that fluctuates between 1200 and 1480 watts. This is shaping up to be the single biggest competitior to Bitmain’s Antminer S9.

With these two features, it’s possible that DragonMint 16T just might upstage Bitmain as the world’s biggest and most efficient bitcoin mining hardware manufacturer. DragonMint 16T currently sells for between $1500 and $3000.

Antiminer R4

If for some reason, you can’t join a mining pool and you still want to mine bitcoins at home, the Antminer R4 is the perfect device for that. It is specifically designed for use at home, hence the quieter nature.

Of course your output won’t be as high as those of the S9 or 16T, you will still produce decent results. This currently has an 8.7Th/s hash rate and a power usage of just 845 watts.

As you can see, incredible power efficiency, even if output isn’t as high. Setting it up is pretty straightforward, making it the ideal bitcoin miner for first time users or hobbyists looking to make an extra income.

This available in for between $1400 and $2500 per unit. This will cover both the unit and its APW5 PSU power supply device.

2018 Bitcoin Cloud Mining Tips

But, what if you don’t want to go through the stress of buying a hardware, and just want a way to pay someone to handle all that so you can do other things? Well, that’s possible in the form of BTC cloud mining.

This involves the use of processing power from a remote data center to mine bitcoins. This is incredibly useful for people looking for a passive, hands free income stream. It basically eliminates the need for buying, setting up running and maintaining a hardware bitcoin miner.

While there are many options, the best known option is known as Hashpower Leasing. With this, you’ll just sign up with a cloud mining service, pay for a certain amount of hashpower, and then wait for them to pay you. The compensation for each service varies, with many paying an agreed sum per month.

While this eliminates the associated downsides of owning a BTC miner hardware, there are also disadvantages, chief of which is high risk of fraud and defaulted payments by the service.

Then, there’s also the possibility of the service shutting down at any time, as well as lower payouts owing to cloud miner’s charges. So, you’ll have to weigh the pros and cons of bitcoin cloud mining and decide if it’s something you want to do.

If you’re in doubt, look up BTC cloud mining service reviews or ask around in popular cryptocurrency forums. Reddit threads are also great for finding and identifying the best and most reliable services.

Why You Need Bitcoin Mining Software

All hardware are often run by software. The same goes for all bitcoin hardware. Your ASIC bitcoin miner should have the correlating bitcoin mining software. And the software itself, must work with the bitcoin consensus software.

If not, you’ll end up dealing with bugs as well as a less efficient hardware. The most common bitcoin mining software available to most mining hardware are:

- CGMIner

- BGFMiner

Ask your mining pool about the right software to install. If you’re going it alone, make sure to use the one that’s compatible for the bitcoin core network.

How Much Can You Make From Bitcoin Mining?

If you’ll be spending four figures on BTC miners, you might as well be sure of how much you’ll be making in return. This will help you determine if it’s worth investing in. but before we delve into bitcoin mining profitability, there are a few things you should know.

The first thing you need to know is that the hash rate has been on the increase since ASIC miners hit the market. This, combined with the lower cost per BTC block, and its inevitable deprecation over time, is something you need to consider.

BTC mining is no longer as profitable as it used to be. Before 2016, miners earned 25 BTC per block mined –that’s currently over $225,000 USD @ over $9k per BTC. Now, it’s at 12.5 BTC per Block.

Come 2020, the reward will depreciate by half, meaning you’ll get paid 6.25 BTC per Block. Of course, you also need to consider that bitcoin is far more valuable now than it was in 2016 when 1 BTC was less than $500 USD. And it looks poised to continue to appreciate in value considering the increased hash rate difficulty as well as miners.

Conclusion

Whatever the case, you can always get an estimate of the potential profit margins by using bitcoin profitability calculator tools like the one on Cryptocompare.com. Mining bitcoins can be profitable if you’re smart and strategic about it.

We hope this guide has helped you, and that you have benefitted from it. Good luck in your bitcoin mining endeavors.